texas estate tax calculator

You might owe money to the federal government though. 1 The type of taxing unit determines which truth-in-taxation steps apply.

Pin On Texas Instruments Electronics

This tool uses the latest information from the IRS including annual changes and those due to tax reform.

. Enter the value of your property. County and School Equalization 2022 Est. FROM - 112018 TO - 12312018.

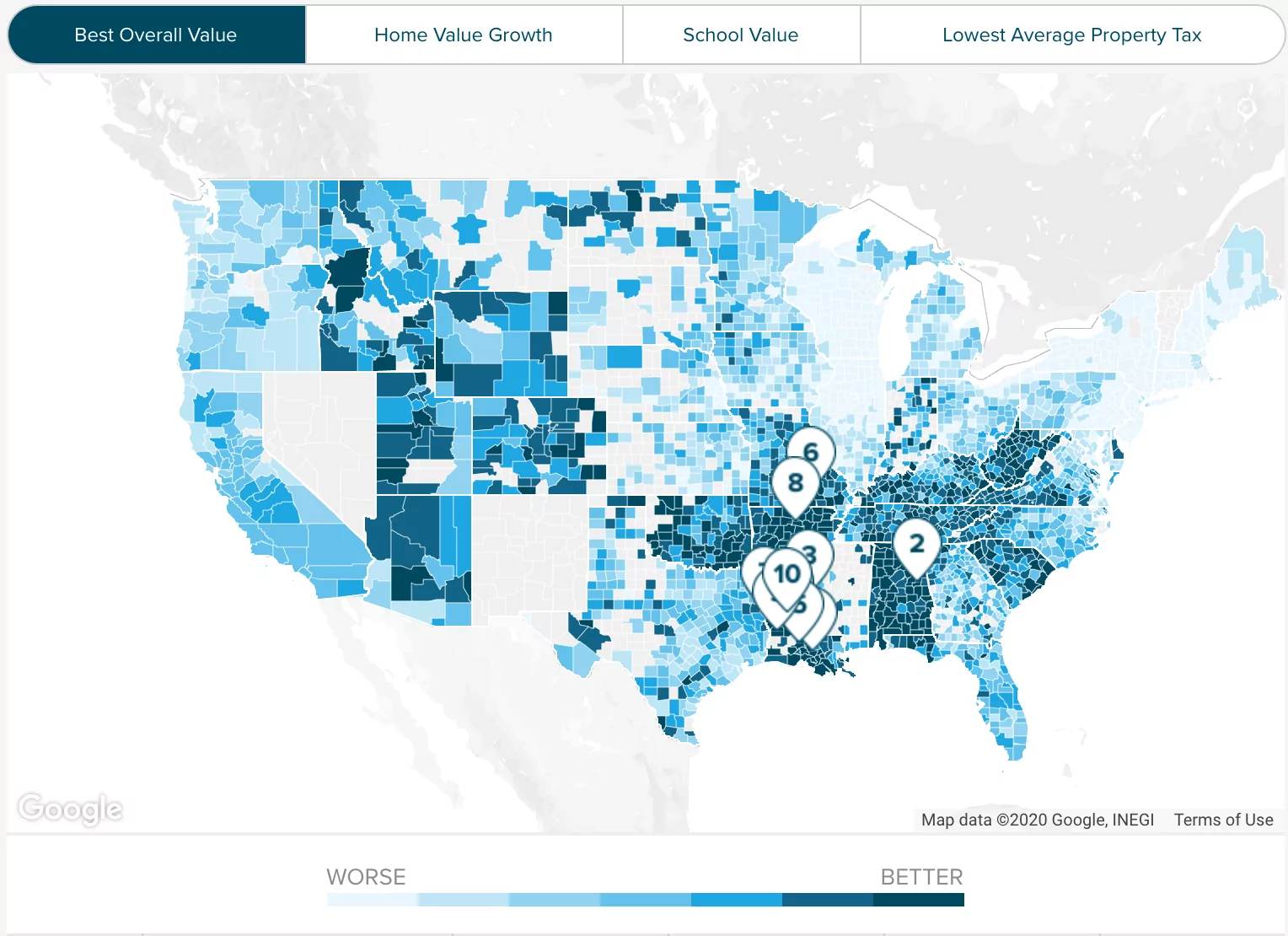

The most common property tax exemption in Texas is the homestead exemption which allows a rebate of at least 25000. Tax Rate City ISD Special District Hospital College General Homestead. The median property tax on a 10180000 house is 184258 in Texas.

An estate tax is a tax imposed on the total value of a persons estate at the time of their death. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. Enter your Over 65 freeze year.

Another commonly used property tax exemption in Texas is the rebate of 10000 for persons who are at least 65 or who are disabled. New Resident Tax Calculator. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Texas local counties cities and special taxation districts.

Choose paid or not paid. Enter your Over 65 freeze year. Use this calculator with the following forms.

The property tax is used to finance the States 254 counties over 1200 cities 1022 independent school districts and more than 1800 special districts. Please choose your exemption. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000.

The local option exemption cannot be less than 5000. A key part of estate planning is helping reduce estate and inheritance tax. Over 65 or Surviving Spouse.

Use this Estate Tax Liability Calculator to determine potential federal estate tax liability for you and your heirs. It is sometimes referred to as a death tax Although states may impose their own estate taxes in the United States this calculator only estimates federal estate taxes Click here to check state-specific laws. Federal Estate Tax.

Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Your information will be updated regularly during. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property. Regardless of the size of your estate you wont owe estate taxes to the state of Texas. The date the purchaser took delivery of the vessel andor outboard motor in Texas or if purchased elsewhere.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in El Paso County. The median property tax on a 10180000 house is 106890 in the United States. VesselBoat Application PWD 143 Outboard Motor Application PWD 144 Date of This Payment.

The property tax in Texas applies to all real property and some tangible personal property in the state. Then enter the local county and school tax amount and enter the tax period ie. Please select your city.

Gather your 2021 financial statements including. Please select your county. School districts are required to offer this exemption while counties have an option for doing so.

Please select your school. Enter your Over 65 freeze amount. For comparison the median home value in Texas is 12580000.

Simply close the closing date with the drop down box. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes.

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. Enter your Over 65 freeze amount.

Calculator is designed for simple accounts. Generally all real estateland and buildingswhether owned by an individual or. Date of Payment cannot be earlier than Date of Sale.

Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value.

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney Estate Tax

Tarrant County Tx Property Tax Calculator Smartasset

Trust Attorney Northern Va Asset Protection Probate Law Virginia Get Assistance With Estate Planning Estate Planning Estate Planning Checklist How To Plan

Property Tax How To Calculate Local Considerations

2021 Capital Gains Tax Rates By State

Not All Property Tax Deductions Are Limited Texas Realtors

New York Property Tax Calculator 2020 Empire Center For Public Policy

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Harris County Tx Property Tax Calculator Smartasset

Capital Gain Tax Calculator 2022 2021

Pin On How To Invest In Real Estate

Should You Move To A State With No Income Tax Forbes Advisor